Picking winners in the race to Iran

Asre Khodro: The third-largest economy in the Middle East has a young, educated populace ready to spend. But U.S. businesses will face big hurdles in the country—if they can get there at all.The third-largest economy in the Middle East has a young, educated populace ready to spend. But U.S. businesses will face big hurdles in the country—if they can get there at all.

سه شنبه ۰۳ شهريور ۱۳۹۴ - ۱۶:۰۹:۰۰

Reporting "Asre Khodro", Ramin Rabii remembers the excitement one night in Tehran about 20 years ago when rumors whipped through the city that a McDonald’s MCD -4.39% franchise would be opening on Valiasr Street. “I showed up there that night, and it was totally packed,” says Rabii, who was 16 at the time. Police arrived at the planned restaurant site to clear crowds from the street, he recalls. But to general disappointment, the new storefront turned out to be a local imitation. The real Big Mac was still banned.

Iranians may not have to wait much longer. The nuclear deal that the U.S. and Europe signed with Iran on July 14 could slowly phase out many economic sanctions, finally allowing Western companies to sell their wares in the country and unleashing one of the world’s largest untapped markets for Western business.

Iran’s $406 billion economy offers immense opportunity. It’s home to 78 million people, many of whom are young, educated, and well traveled, with money to spend—and not just on hamburgers. Already some believe there are 6.5 million iPhones—not counterfeit—in circulation, even though Apple AAPL -2.50% is barred from selling products directly in Iran.

In many industries, embargoes have contributed to what amounts to 36 years of pent-up demand. Iran’s national airline has planes that are on average 23 years old, and officials say they plan to spend $20 billion on 400 new aircraft over the next decade—good news for Boeing BA -3.43% , which already provides parts and maintenance under a special permit. There are few major international hotel chains or car dealerships in Iran, which has hospitality executives and automakers salivating. And Iranian officials say they intend to invest billions in upgrading creaky oil and gas facilities, which could mean a windfall for oil-services firms.

“There is not a single week when we don’t host at least one or two foreign delegations,” says Rabii, who hankered for a McDonald’s store as a teenager and is now CEO of Tehran investment firm Turquoise Partners. “They all say they want to be the first in Iran,” he says.

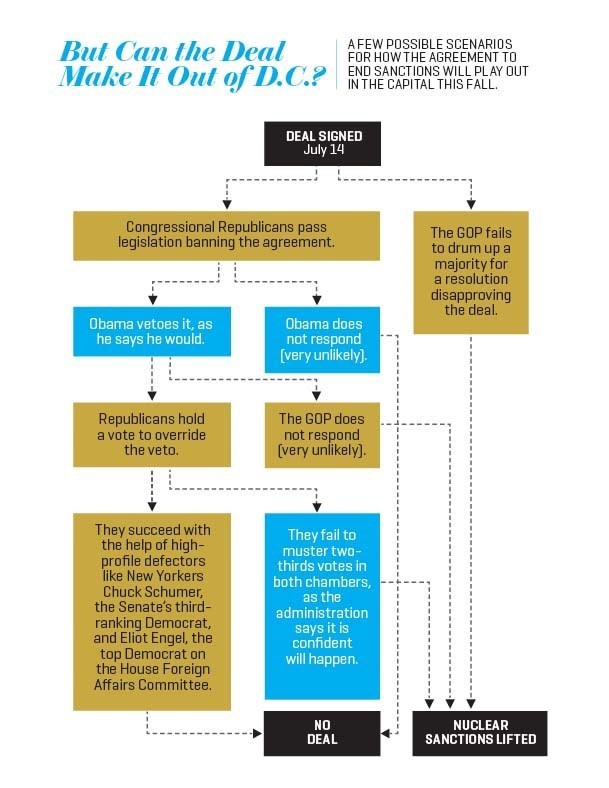

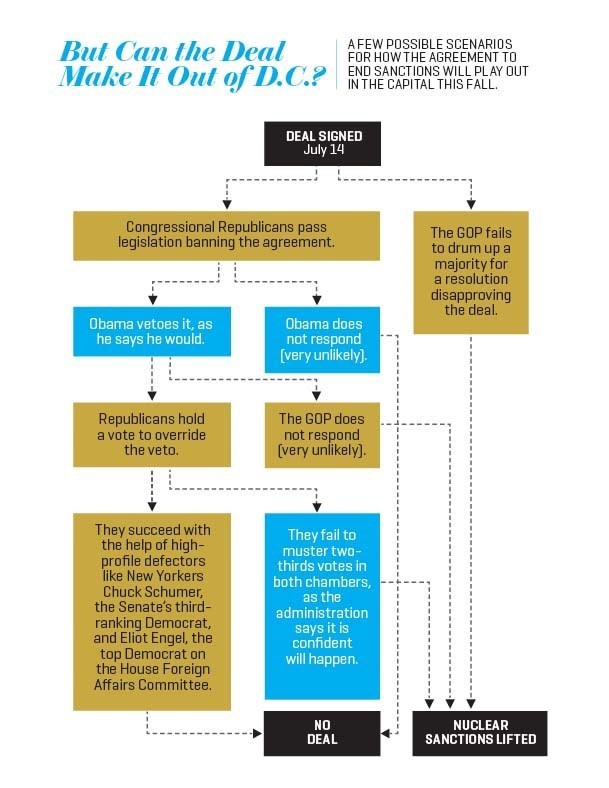

That seems unlikely for most U.S. companies. The new deal still faces a bumpy path to approval in D.C., and even if it is approved, sanctions related to human rights abuses—rather than nuclear weapons—will remain in place. The big change will be Treasury allowances for foreign subsidiaries of U.S.-owned companies, as well as products related to aviation, food, and medicine.

European competitors, by contrast, look set to sign major deals quickly. Mercedes-Benz, Peugeot, and Renault have announced plans this summer to start selling to Iran’s huge auto market, with which they already have deep ties (Iran was Peugeot’s biggest market outside France until 2011). And French hotel chain Accor is set to open a hotel later this year.

Once U.S. businesses arrive they will still face major challenges. Global risk consultant Verisk Maplecroft warned clients of Iran’s “cumbersome and bloated bureaucracy as well as high levels of political interference.” It also cautions that conflict could flare between Iran’s increasingly wired, savvy youth and the powerful clerics who run the country.

Yet for all that, in late July McDonald’s posted a notice seeking franchise partners for Iran, looking for those with “high integrity,” experience, and a record of success. Iranians may soon get their Big Macs—this time for real.

Who comes out ahead in Iran

Winners

EU automakers: Daimler AG/Mercedes-Benz, Peugeot, and Renault are all well positioned for Iran’s large auto market.

Oil-services companies: Iran says it needs $230 billion worth of upgrades to its energy facilities, good news for Schlumberger and Halliburton.

Airplane makers: Iran plans to buy 400 planes in the next decade, a boon for Boeing and Airbus.

Losers

Russian oil and gas firms: Iran aims to double its oil exports, which could drive down global prices and hit Russia particularly hard in its key markets of Asia and Europe.

Pistachio growers: Nut growers in California have benefited from sanctions, but Iranian farmers are prepping for a big return. — Tory Newmyer

A version of this article appears in the September 1, 2015 issue of Fortune magazine.

Source: fortune.com