۲۰۱۷ Germany: Best-Selling Car Manufacturers and Brands

Asre Khodoro- In ۲۰۱۷, Volkswagen remained the top-selling car brand in Germany ahead of Mercedes Benz, Audi and BMW. Ford outsold Opel.

By: Hani Hardanian

Reporting "Asre Khodoro", Volkswagen had weaker sales and lost market share but easily remained the largest carmaker in Germany in 2017. Second placed Mercedes Benz increased sales and gained market share while Audi and BMW both had weaker sales. Ford became the fifth best-selling car brand in Germany in 2017 while Opel fell back to sixth. Skoda remained the top-selling foreign car brand in Germany in 2017 while Renault was the most-popular French car in Germany and Hyundai the best-selling South Korean car brand.

The German New Car Market in 2017

New passenger vehicle registrations in Germany in 2017 increased by 2.7% to 3,441,262 cars. This was the fourth consecutive year that the German new car market exceed 3 million cars.

See 2017 Developments on the German New Car Market for more details on the composition of the German vehicle market and annual car sales figures.

Best-Selling Car Manufacturers in Germany in 2017

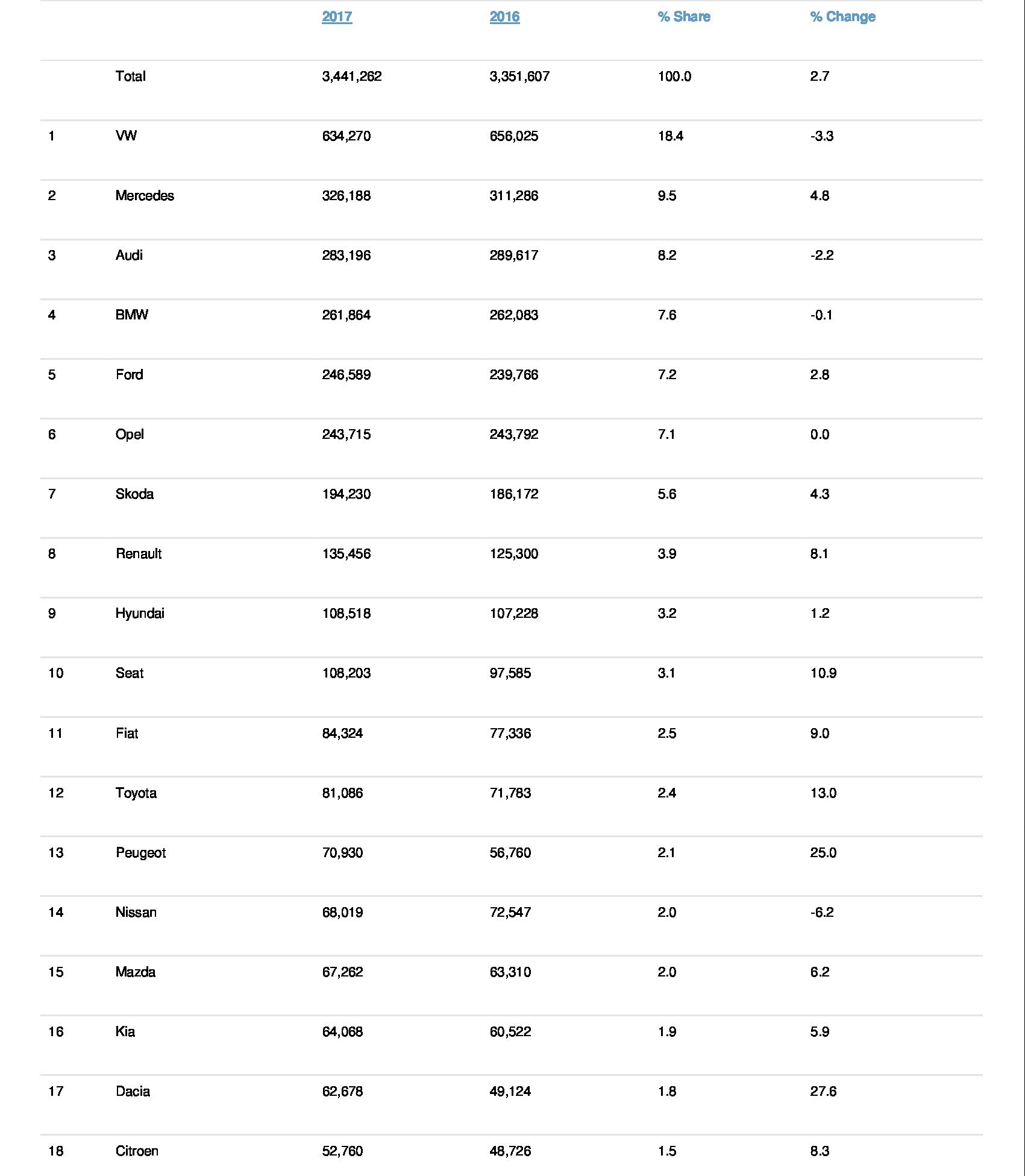

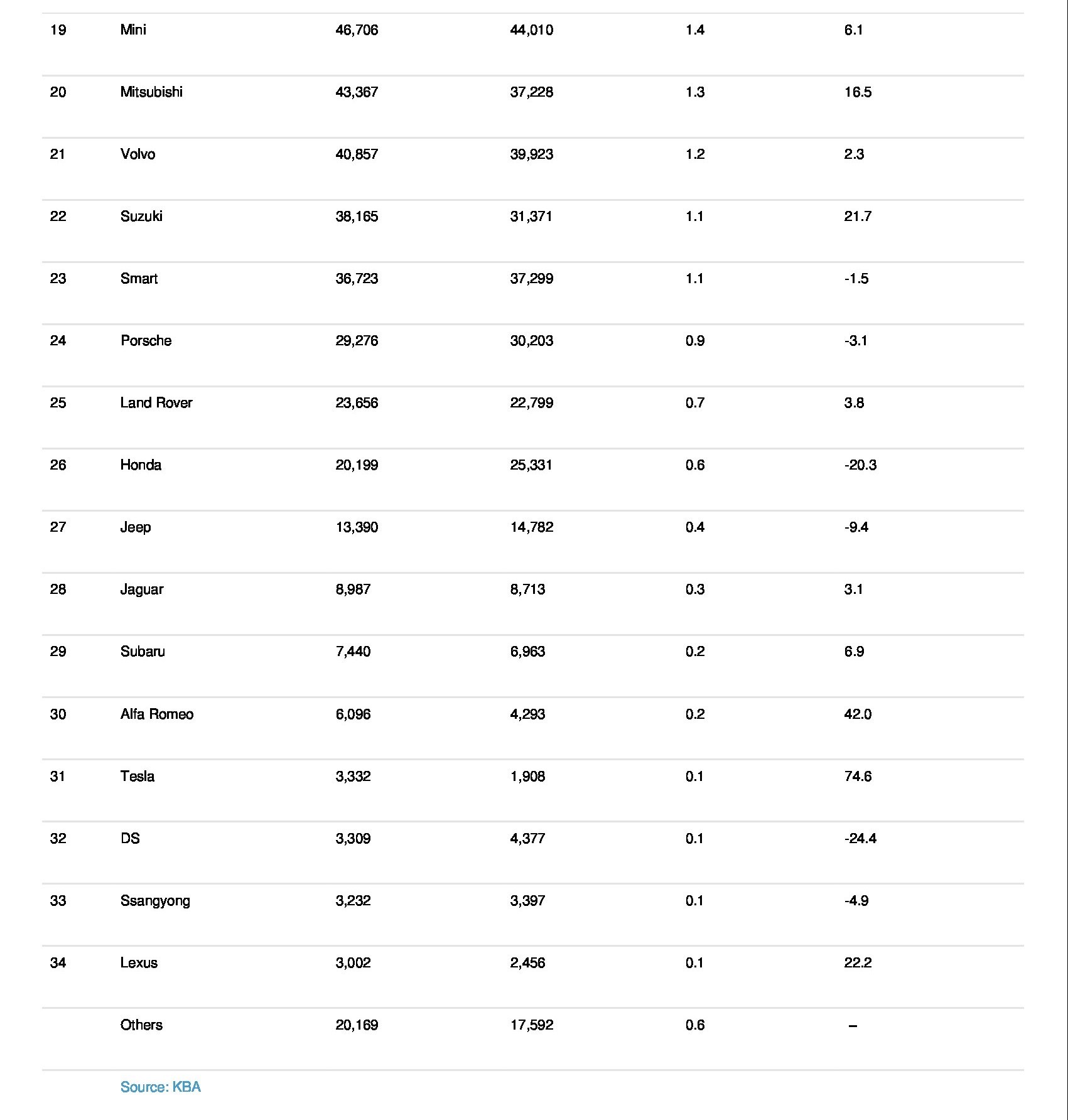

The top-selling car marques in Germany in 2017 according to new passenger vehicle registration data released by the KBA were:

Top-Selling Car Brands in Germany in 2017

Volkswagen easily remained the largest carmaker in Germany in 2017 but for the second consecutive year VW had weaker sales in a growing market. VW sales were down 3.3% for an 18.4% share of the German new car market. Volkswagen’s market share of new car sales in Germany was 19.6% in 2016 and 21.4% in 2017. However, towards the end of the year, VW sales improved strongly helped by discounting, new models and incentives.

Mercedes Benz increased car sales in Germany in 2017 by 5% or 15,000 cars while VW sold around 22,000 fewer cars than in 2016. Mercedes Benz solidified its lead in the premium car market: Audi sales were weaker and BMW sales were flat.

The only change in rank order amongst the top ten carmakers in Germany in 2017 was Ford finally moving ahead of Opel. Ford sales increased just above market average while Opel sales were down by 77 cars. Despite foreign ownership both Ford and Opel are considered German brands in Germany.

The top foreign brands performed generally better in Germany in 2017 than the domestic marques. VW-owned Skoda remained the top import car brand in Germany in 2017 with sales up by 4%. Renault performed even better with sales up 8% or 10,000 cars. Hyundai sales were only slightly stronger while VW-owned Seat was the most-improved top-ten brand in Germany in 2017 and missed out on 9th place by only 300 cars.

Fiat maintained 11th place with sales up 9%. Toyota sales in Germany in 2017 were up 13% and one rank position. Peugeot sales increased by a quarter or three rank places. Nissan, Mazda and Kia all moved down the ranks despite Mazda and Kia outselling the broader market.

Dacia had the strongest sales increase of the top 20 brands but kept its rank position from last year, as did Citroen and Mini that also had strong sales. Mitsubishi entered the top 20 list at the expense of Volvo.

Tesla, Alfa Romeo, Dacia and Peugeot were the most-improved brands in Germany in 2017. The worst performing brands were DS, Honda, Jeep and Nissan. In volume terms, VW lost the most with sales down by 22,000 cars.

See 2017 Developments on the German New Car Market for more details on the composition of the market and historical growth figures.

2018 International: Worldwide Car Sales Prediction

The global passenger car market in 2018 is predicted by the VDA to grow by one percent to 85.7 million vehicles.

The VDA "German automotive industry association", predicts that car sales worldwide will increase by 1% to 85.7 million cars. Car sales in Europe will expand slightly but the British and German markets are likely to contract. The US market is unlikely to expand in 2018. China will remain the world’s largest car market in 2018 with a 2% growth in sales to just less than 25 million cars. The Indian, Brazilian and Russian car markets are expected to expand further in 2018. German car brands are predicted to increase sales worldwide in 2018 and are leading patent holders for electric and autonomous vehicles.

Global Passenger Car Market in 2018 Prediction

According to Matthias Wissmann, President of the German Association of the Automotive Industry (VDA), global passenger vehicle sales in 2018 will grow globally by one percent to 85.7 million vehicles. Growth in new passenger vehicle registrations is predicted for most major regions of the world in 2018 but a slight contraction is possible in Western Europe. And the USA

Car Sales Predicted for Europe in 2018

The VDA predicts that new passenger car sales in Europe in 2018 will maintain the high levels of 2017 with around 15.6 million new registrations in the European Union (EU) and EFTA countries.

The VDA expects the West European car market – the older 15 EU member states – to contract by 1% to just over 14.2 million cars. This contraction will be mostly as a result of falling car sales in Britain. The VDA predicts that new passenger vehicle registrations in the UK will contract by 5% in 2018.

The VDA predicts that car sales in Germany will remain near its current high level of around 3.4 million units. The German new car market may contract by around 2% in 2018.

Worldwide Car Sales Growth Predicted in 2018

The VDA predicts that the US new passenger vehicle market including traditional passenger cars and light trucks / SUVs will continue to lack dynamism in 2018. A slight contraction of 2% is predicted to 16.8 million vehicles, which is a relatively high number.

The VDA expect other major markets in the world to expand in 2018:

China will easily maintain its position as the world’s largest single-country car market with car sales expected to increase by a further 2% to reach 24.6 million cars.

The Indian new car market is expected to expand by another 10% in 2018 to reach 3.6 million vehicles and exceed the size of the German new car market for the first time ever.

The VDA also expects the Russian and Brazilian new car markets to continue their recovery in 2018 but did not publicly predict the size of the expansion.

German Car Production in 2018 Prediction

The VDA expects car production by German brands to increase by 2% in 2018 to 16.7 million vehicles:

An unchanged 5.6 million cars will be produced in Germany, of which 4.3 million will be exported. Foreign production of German brands will increase by 3% to 11.1 vehicles.

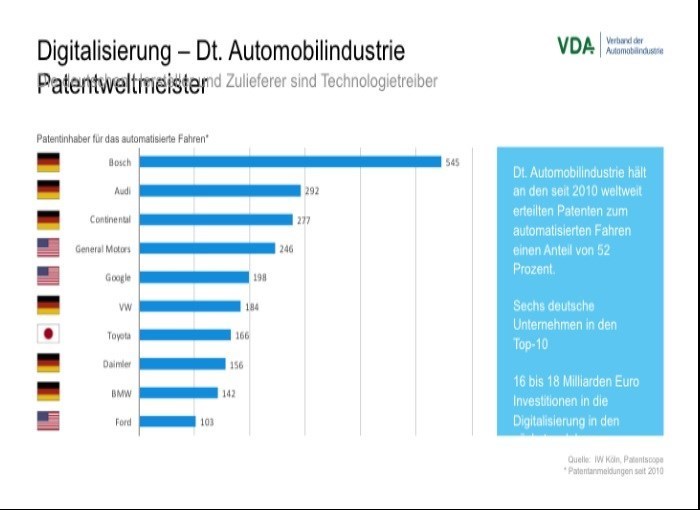

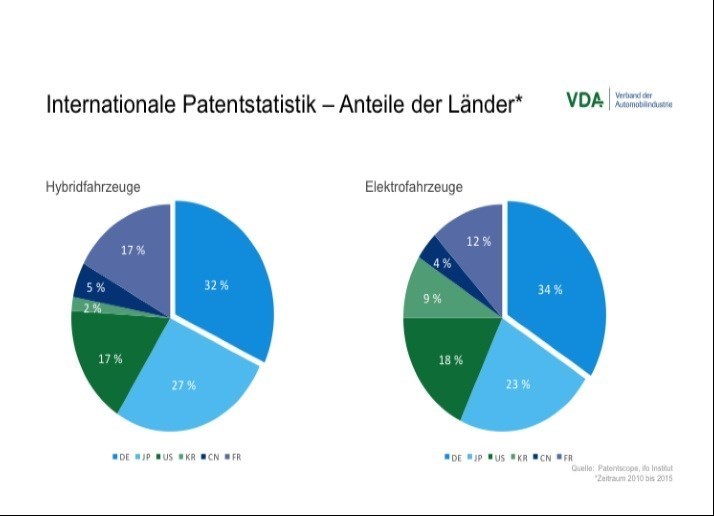

The VDA also pointed out that the German car industry remains a leader in new technologies. A third of all new patents related to electric and hybrid cars were awarded to German companies between 2010 and 2015.

Similarly, German companies – led by Bosch – own the highest number of patents related to autonomous driving.

References:

1. https://www.vda.de/en.html

2. https://www.best-selling-cars.com

3. https://www.kba.de

هاچبک پرفورمنس BYD وارد خط تولید میشود

با ۵ دقیقه شارژ ۳۰۰ کیلومتر پیمایش کنید

مرکز اسقاط سایپاخزر در قائم شهر راه اندازی شد

اعمال قانون بیش از ۲۱۰۰۰خودرو و موتورسیکلت به دلیل پوشش پلاک

آیین نامه واردات خودروهای کارکرده کجاست؟

الزام استفاده از شناسه کالا برای ثبت سفارش های صنایع خودرو

تضعیف جایگاه نیسان در تایلند با حضور برندهای چینی

الزام خودروسازان به تخصیص سهمیه ۲۰ درصدی برای مالکان خودروهای فرسوده

آیا روند مجوزدهیها تسهیل خواهد شد؟

تغییر گسل قیمت خودرو

الصاق عکس پلاک به قبض؛ دیگر جریمه اشتباهی نداریم!

دوربرگردان عرضه خودرو از جاده مخصوص به بورس کالا

بزرگترین تولیدکننده باتری اروپا اعلام ورشکستگی کرد

۶۶۳۶ دستگاه خودروی دیزلی معطل شماره گذاری پلیس

اخراج و تعطیلی کارخانه گریبانگیر فولکسواگن