- Friday 28 October 2016 - 21:07:00

Groupe Renault: third quarter revenue up 13 per cent

Asre Khodro: In a global automotive market up 5 per cent, Groupe Renault’s registrations rose by 16 per cent to 721,741 units. The group’s market share increased by 0.3 points to 3.3 per cent.

Reporting "Asre Khodro", The group continued to enjoy traction from the renewal of its range in a buoyant European market (+5.3 per cent). Its registrations rose by 11.3 per cent, with market share gaining 0.5 points to 9.5 per cent.

Sales under the Renault brand grew by 8.1 per cent thanks to the success of new Mégane, Kadjar, Espace and Talisman models. Clio IV remains the second bestselling vehicle in Europe and Captur was again the leading crossover in its class. In Europe, in the electric vehicle segment, Renault’s market share came to 20.8 per cent in the third quarter, while ZOE posted a 22.4 per cent growth.

Sales under the Dacia brand increased by 22.1 per cent, due chiefly to Sandero Stepway and Duster.

In France, the group outperformed the market with a 3.9 per cent rise in registrations to 123,000 vehicles in the quarter. The group placed five vehicles in the Top 10 best-selling passenger cars at the end of September, with Clio IV coming in at number one and Captur leading its segment. Sandero remains the best-selling car to retail customers, at the end of September and for the third quarter.

Internationally, despite turbulence in Brazil, Russia and Algeria, group sales increased by 21.5 per cent in the third quarter. The group increased its market share in each region.

In the Africa, Middle East and India Region, the group’s registrations were up by 85 per cent as market share gained +2.7 points to 6.4 per cent.

In Iran, Groupe Renault confirmed the trend of the first half of 2016, with deliveries up 135.5 per cent thanks to the success of Logan and Sandero. The group’s market share increased by 2.9 points to 9.6 per cent.

In India, the market grew 17 per cent while Renault registrations were multiplied sevenfold thanks to the success of Kwid. 82,771 Kwids have been registered since the start of the year, including 34,350 in the third quarter alone.

In North Africa, Groupe Renault registrations rose by 13.6 per cent, in a market down 15 per cent. Market share increased by 10.6 points to reach a record 42.2 per cent. In Algeria, the market continues to be weakened by the current regulations setting import quotas. Within this context, the group consolidated its lead in the country with a market share of 63.1 per cent, a gain of 29.2 points. The three best-selling vehicles were Symbol and Sandero – both of which are manufactured at the Oran plant – and Logan.

In the Americas Region, the group’s market share increased by 0.2 points to 6.9 per cent.

The Renault brand continued to benefit fully from the recovery of the Argentinean market, with its registrations up 21.7 per cent in a market up 12.7 per cent. In Brazil, in an automotive market down sharply (-17 per cent), the group held up well, increasing its market share by 0.4 points to 7.8 per cent. The end-2015 launch of Oroch and the upcoming launch of Alaskan are enabling the group to expand its offering and position itself in the pick-up segment.

In Eurasia, the group’s market share improved by 0.7 points to 12.4 per cent. In Russia, where total industry registrations fell by 15.1 per cent, Renault held up well, registering a limited 4.7 per cent decline. Market share expanded 0.9 points to 8.3 per cent, due to the successful launch of Kaptur, for which more than 7,500 orders have been placed since its launch in June 2016. In Turkey, the group was impacted by the market decline, with sales down 23.1 per cent.

In Asia Pacific, the group’s registrations rose by 25.6 per cent in a market up 11.5 per cent. In South Korea, the group’s largest market in the region, Renault Samsung Motors posted 24.5 per cent growth, driven by the success of its new SM6 sedan and its QM6 crossover. Market share expanded 1.9 points to 6.3 per cent over the period. In China, pending the upcoming launch of Koleos, 10,686 Kadjar have been registered since the model’s introduction in March, including 6,032 in the third quarter alone. The sales network, which currently encompasses 125 dealerships, is expected to grow to 150 outlets by the end of the year.

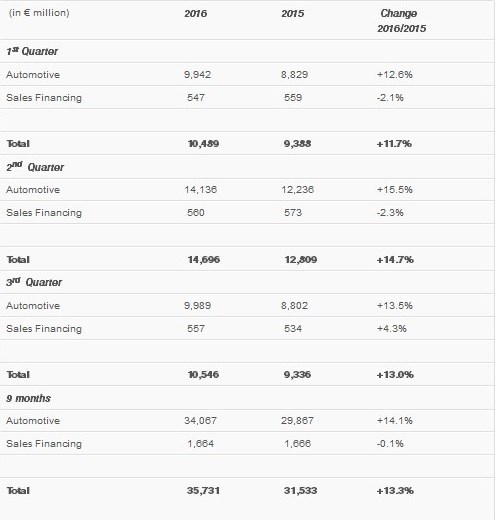

THIRD-QUARTER REVENUES BY OPERATING SECTOR

In the third quarter of 2016, the group’s revenues came to €10,546 million, a 13.0 per cent increase compared to the previous year (+16.7 per cent increase at constant exchange rates).

Automotive revenues came to €9,989 million, up 13.5 per cent thanks to an increase in volume (+10.7 points) and pricing (+4.6 points). This last effect still benefits from price increases in emerging countries to offset currency declines, but as well from recent launches. Growth in Sales to Partners (+1.8 points) reflects the positive momentum of our CKD[1] activities in Iran and China, as well as the increased production of vehicles to our partners in Europe. The euro’s gain against a number of currencies, including the Argentinean peso and the British pound, resulted in an unfavourable impact of 3.8 points. Product mix is negative this quarter (-2.5 points), mainly due to the impact of Kwid in the group’s sales.

Sales Financing (RCI Banque) reported revenues of €557 million, up 4.3 per cent compared with the third quarter of 2015. The number of new financing contracts rose by 10.0 per cent. Average performing assets increased by 17.5 per cent to €33.9 billion.

OUTLOOK FOR 2016

In 2016, the global market is expected to record growth around 1.7 per centcompared to 2015. The European market, as well as the French one, are now expected to increase by at least 5 per cent.

Outside Europe, the Brazilian and Russian markets are expected to decline: -15 per cent to -20 per cent for Brazil and -12 per cent for Russia. On the contrary, China (+4 per cent to +5 per cent) and India (+7 per cent to +9 per cent) should pursue their positive momentum.

Within this context, Groupe Renault (at constant scope of consolidation) confirms its full-year 2016 guidance:

Increase group revenues (at constant exchange rates)

Improve group operating margin

Generate a positive Automotive operational free cash flow

Groupe Renault consolidated revenues

- Renault

مدل جدید پرفروشترین خودرو فرانسوی معرفی شد

Renault sales decline 6.7% in first half of 2019

Renault to Return to Iran: Deputy Minister

Renault to stay in Iran despite US sanctions

SAIPA Hands Over Bonro Factory to Renault

Renault breaks records with its friends!

Renault's Mueller quits, clearing CEO succession path

Renault Lead the Way, Nissan Climb

The Renault partnership in Russia changes the investment location in Iran

Renault management confirms three new Renault Kwid family members

Iran Has 4% Share in Renault’s Int’l Sales

Renault Exports to Iran Rises by 83%

Renault's Plan for Iran Auto Market

Achievements of Renault’s investment in Iran auto industry

Renault has reached to the top market for imported cars in Iran

SUVs Dominating Iran Car Market

Renault adds local engine plant to Iran JV agreement

Renault Sets Up New Iran Partnership Amid U.S. Trade Tensions

Groupe Renault signs a new joint venture in Iran

Renault started launching in Saveh

Iran's contract with Renault was signed

Who won signs the contract of the largest investment in the Iranian automotive industry?

Producing of 150,000 vehicles in the first phase with investments of 660 million euros

Negin Khodro ended the Korean monarchy in Iran's car market

Two French Carmakers Moving Ahead at Full Speed

The last Breathtaking Moments of the Largest Investment Contract in Iran's Automotive History

The most advanced ABS brake line in Iran is launched

The partnership agreement with Renault is in the final stages of the work

The Unending Saga of ‘Localization’ in Iran Auto Industry

PSA hires Renault-Nissan exec to lead push in Africa

Iranian Firm to Introduce New Megane

Renault-Nissan seeks Ghosn heir to drive integration

Groupe Renault senior management appointment

Renault Iran Chief Taking Over Reins at Nissan India

Revenues increase 25.2% in the first quarter

UPDATE 1-Renault revenue lifted by new models, Lada consolidation

Iran Dedicated Training Center to be Operational by the End of the Current Year

IDRO, Renault Deal in the Offing

Nissan makes two key appointments in region

Renault Imports to Iran Increase 110%

Renault Reportedly to Operate Independently

The Renault Kwid at 3,500 euros, the keys to success

Renault-Nissan sales close to 10 million in 2016 Join our daily free Newsletter

Renault boasts record year despite diesel probe

Iran to Finalize Deal with Renault in Weeks: Minister

IDRO signs 19 MOUs with giant automakers in post-sanction era

Iran stars as Renault powers to record 2016 sales

Renault Duster May Be Obsolete

Renault Trucks, Arya Diesel Motors Sign 2 Agreements

Renault Trucks signs two agreements with Iranian importer Arya Diesel Motors

Renault’s 11-month sales to Iran up 146% yr/yr

Renault Brands in Iran Auto Show

Renault Sales in Iran Up by 127% in September

Renault Kwid spotted in Iran, to be manufactured locally

Renault Looks to Grow Automotive Presence in Iran

Renault signs MoU with Iran to create new joint venture

Renault Trucks appoints new president for Greater Middle East region

Rise of Koreans!

Record Registrations for Groupe Renault in H1 2016

Renault to enter Iran’s car market with 5 new products

Renault’s Iranian market share rises 7-fold in post-sanction era

Renault eyes launching new production lines in Iran

Iranian automaker to sign contract with Renault

FCA, PSA, Renault eye deals as Iran president tours EU

Iran's President says Peugeot, Renault deals possible on Europe trip

Franco-Japanese auto giant keen on Iran expansion

Renault November sale to Iran skyrocketed

Renault-Nissan's French peace deal leaves investors underwhelmed

Renault’s one-month sales to Iran up 2.5 folds yr/yr

Renault Sandero assembly line launched in Iran

French carmakers duel over Iran

Renault Symbol unveiled in Iran

Renault never left Iran during sanctions

Controversial Vehicle Price Surge in Iran

IKCO management handed over to consortium of non-governmental shareholders

Iran's government approved car import after four years

$2 Billion Aid Package to Bolster Automotive Industry

Renault sales decline 6.7% in first half of 2019

FIAT cars will be manufactured in Salafchegan, Iran

Car, mobile price fluctuations in Iran puzzling people

IKCO, Azad University Sign R&D Agreement

When will Azerbaijan start producing Peugeot 207?

Iran Annual Auto Output Report: 2018-19

Automotive Industry has exceeded the targets with “Automechanika Istanbul” which the World's 3rd Largest Fair!

Sout Korea’s auto exports down 1.6% in Feb.

Renault to Return to Iran: Deputy Minister

Chery's luxury brand will soon be on the market

Warm start for arrizo6 in Ahwaz